Implantable Polymer Electronics Industry Report 2025: Market Growth, Technology Innovations, and Strategic Insights for the Next 5 Years

- Executive Summary & Market Overview

- Key Technology Trends in Implantable Polymer Electronics

- Competitive Landscape and Leading Players

- Market Growth Forecasts (2025–2030): CAGR, Revenue, and Volume Analysis

- Regional Market Analysis: North America, Europe, Asia-Pacific, and Rest of World

- Future Outlook: Emerging Applications and Investment Opportunities

- Challenges, Risks, and Strategic Opportunities

- Sources & References

Executive Summary & Market Overview

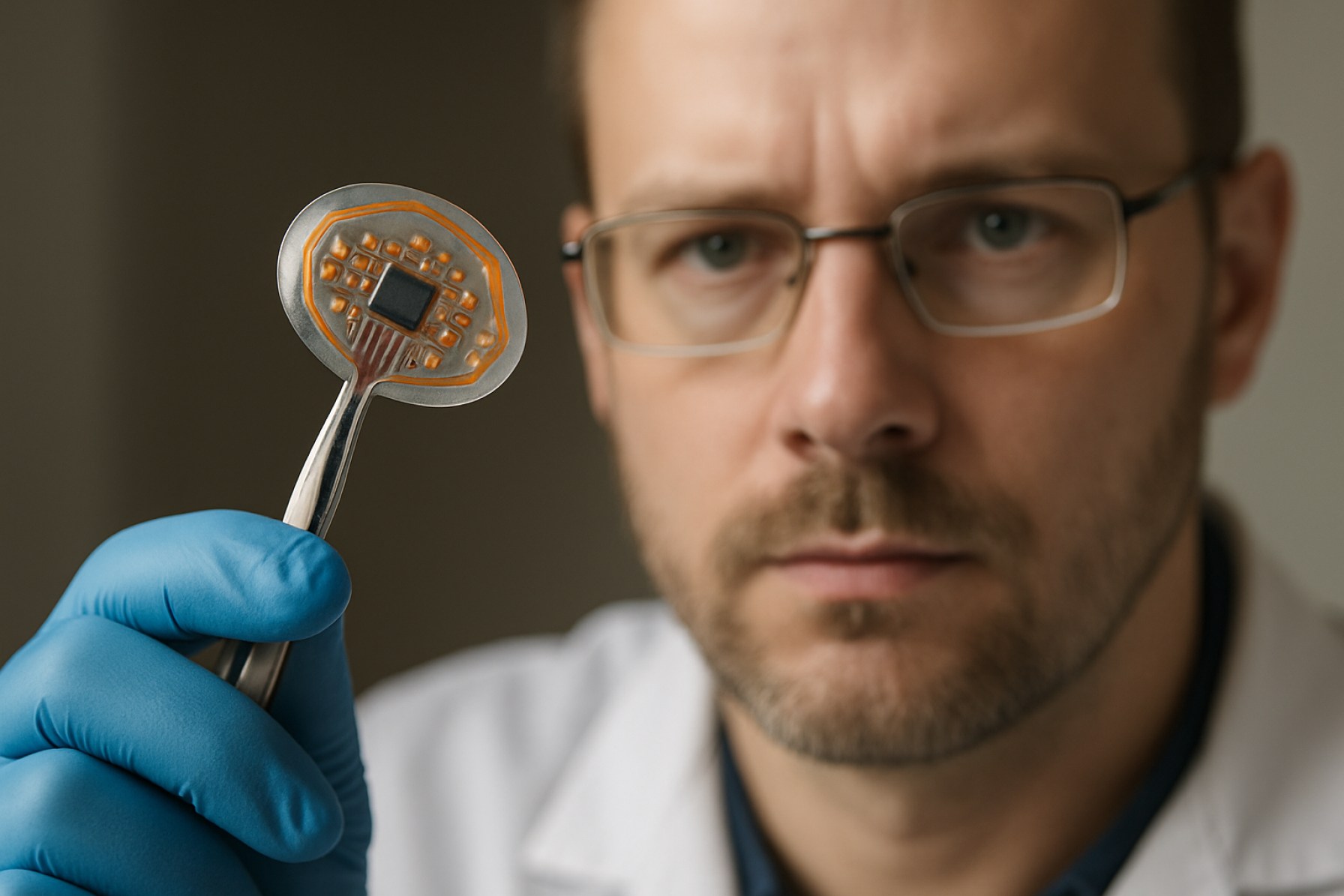

Implantable polymer electronics represent a rapidly advancing segment within the broader medical device and bioelectronics markets. These devices leverage the unique properties of conductive and semiconductive polymers—such as flexibility, biocompatibility, and tunable electrical characteristics—to create next-generation implants for diagnostics, monitoring, and therapeutic applications. As of 2025, the global market for implantable polymer electronics is experiencing robust growth, driven by increasing demand for minimally invasive medical solutions, the rising prevalence of chronic diseases, and ongoing innovation in materials science.

According to recent analyses, the global implantable electronics market is projected to reach USD 25.2 billion by 2025, with polymer-based devices accounting for a growing share due to their superior integration with biological tissues and reduced risk of immune response compared to traditional metal-based implants (MarketsandMarkets). Key application areas include neural interfaces, cardiac rhythm management, biosensors, and drug delivery systems. The flexibility and processability of polymers enable the fabrication of ultra-thin, stretchable, and even biodegradable devices, opening new possibilities for both temporary and long-term implantation.

- Neural Interfaces: Polymer-based electrodes and transistors are being developed for brain-computer interfaces and neuroprosthetics, offering improved signal fidelity and patient comfort (Nature Nanotechnology).

- Cardiac Devices: Conductive polymers are used in pacemaker leads and defibrillator components, enhancing device longevity and reducing complications (BioSpace).

- Biosensors: Implantable polymer biosensors enable real-time monitoring of biomarkers, supporting personalized medicine and chronic disease management (IDTechEx).

The competitive landscape is marked by collaborations between academic institutions, startups, and established medical device manufacturers. Notable players include Medtronic, Boston Scientific, and emerging innovators such as Neuralink. Regulatory agencies, including the U.S. Food and Drug Administration (FDA), are actively updating guidelines to address the unique challenges and safety considerations of polymer-based implants.

In summary, the implantable polymer electronics market in 2025 is characterized by technological breakthroughs, expanding clinical applications, and a favorable regulatory environment, positioning it as a key driver of innovation in the future of healthcare.

Key Technology Trends in Implantable Polymer Electronics

Implantable polymer electronics represent a rapidly evolving frontier in biomedical engineering, leveraging the unique properties of organic polymers to create flexible, biocompatible, and multifunctional devices for in-body applications. As of 2025, several key technology trends are shaping the development and adoption of these devices, driven by advances in materials science, miniaturization, and integration with digital health platforms.

- Flexible and Stretchable Electronics: The shift from rigid silicon-based devices to flexible polymer substrates enables electronics that conform to soft tissues, reducing mechanical mismatch and improving long-term biocompatibility. Innovations in conductive polymers and elastomers, such as PEDOT:PSS and polydimethylsiloxane (PDMS), are central to this trend, allowing for chronic implantation with minimal tissue irritation (Nature Reviews Materials).

- Bioresorbable and Biodegradable Devices: Researchers are developing implantable electronics that safely dissolve or degrade in the body after fulfilling their function, eliminating the need for surgical removal. Polymers such as polylactic acid (PLA) and polycaprolactone (PCL) are being engineered for controlled degradation rates, supporting applications in temporary monitoring and drug delivery (Materials Today Bio).

- Wireless Power and Data Transmission: Advances in wireless energy transfer and communication protocols are enabling fully untethered polymer-based implants. Inductive coupling, radiofrequency (RF) harvesting, and near-field communication (NFC) are being integrated into polymer electronics, supporting real-time data transmission and remote device control (IEEE).

- Integration with Biosensing and Therapeutics: Implantable polymer electronics are increasingly being designed as multifunctional platforms, combining sensing, stimulation, and drug delivery. For example, polymer-based neural interfaces can record electrophysiological signals while delivering localized electrical or pharmacological therapy, advancing personalized medicine (Nature Nanotechnology).

- Scalable Manufacturing and Customization: Emerging fabrication techniques such as inkjet printing, roll-to-roll processing, and 3D printing are making it feasible to produce complex polymer electronic devices at scale and with patient-specific geometries, reducing costs and improving clinical outcomes (IDTechEx).

These trends are collectively accelerating the clinical translation of implantable polymer electronics, with the global market expected to see robust growth as regulatory pathways and reimbursement models adapt to these novel technologies.

Competitive Landscape and Leading Players

The competitive landscape of the implantable polymer electronics market in 2025 is characterized by a dynamic mix of established medical device manufacturers, innovative startups, and academic spin-offs, all vying for leadership in a rapidly evolving sector. The market is driven by the growing demand for minimally invasive medical devices, advancements in biocompatible polymers, and the integration of electronics for real-time monitoring and therapeutic applications.

Key players in this space include Medtronic, Boston Scientific, and Abbott Laboratories, all of which have expanded their portfolios to include polymer-based implantable devices, particularly in cardiac rhythm management and neurostimulation. These companies leverage their established regulatory expertise, global distribution networks, and significant R&D investments to maintain a competitive edge.

Emerging companies such as neuroloop and Neuralink are pushing the boundaries of polymer electronics with next-generation neural interfaces and bioelectronic medicines. Their focus on flexible, biocompatible polymers enables the development of devices that conform to complex anatomical structures, reducing tissue damage and improving long-term performance.

Academic and research institutions, including collaborations with industry, play a pivotal role in innovation. For example, the Massachusetts Institute of Technology (MIT) and Stanford University have spun out startups and licensed technologies that utilize conductive polymers for soft, implantable sensors and stimulators.

- Strategic Partnerships: Leading players are increasingly forming alliances with material science companies and electronics manufacturers to accelerate product development. For instance, Medtronic has partnered with specialty polymer suppliers to enhance device longevity and biocompatibility.

- Intellectual Property: The market is marked by a robust patent landscape, with companies aggressively protecting innovations in polymer formulations, device architectures, and integration techniques.

- Regulatory Approvals: Gaining regulatory clearance remains a key differentiator. Companies with a track record of successful FDA and CE Mark approvals, such as Boston Scientific, are better positioned to commercialize new implantable polymer electronic devices.

Overall, the competitive environment in 2025 is shaped by rapid technological advancements, strategic collaborations, and a focus on regulatory compliance, with both established leaders and agile newcomers contributing to market growth and innovation.

Market Growth Forecasts (2025–2030): CAGR, Revenue, and Volume Analysis

The market for implantable polymer electronics is poised for robust growth between 2025 and 2030, driven by technological advancements, increasing prevalence of chronic diseases, and rising demand for minimally invasive medical devices. According to projections by MarketsandMarkets, the global implantable electronics market—which includes polymer-based devices—is expected to register a compound annual growth rate (CAGR) of approximately 8–10% during this period. This growth is underpinned by the unique advantages of polymer electronics, such as enhanced biocompatibility, flexibility, and the ability to integrate with soft tissue, which are critical for next-generation implantable devices.

Revenue forecasts indicate that the implantable polymer electronics segment will see its market value rise from an estimated $1.2 billion in 2025 to over $2.1 billion by 2030. This projection is supported by data from Fortune Business Insights, which highlights the increasing adoption of polymer-based sensors, stimulators, and drug delivery systems in neurology, cardiology, and orthopedics. The volume of units shipped is also expected to grow at a CAGR of 9–11%, reflecting both the expansion of clinical indications and the growing acceptance of these devices among healthcare providers and patients.

- Neurological Implants: The segment is forecasted to experience the fastest growth, with a CAGR exceeding 11%, as polymer-based electrodes and neural interfaces gain traction for treating conditions such as epilepsy, Parkinson’s disease, and chronic pain.

- Cardiac Devices: Polymer electronics are increasingly used in pacemakers and defibrillators, with the market for these applications projected to grow steadily at around 8% CAGR.

- Drug Delivery Systems: The integration of polymer electronics in implantable drug delivery devices is expected to see a CAGR of 10%, driven by demand for precision medicine and controlled release therapies.

Regionally, North America and Europe are anticipated to maintain their dominance due to established healthcare infrastructure and high R&D investment, while Asia-Pacific is projected to witness the highest CAGR, fueled by expanding healthcare access and government initiatives supporting medical innovation (Grand View Research).

Overall, the 2025–2030 period will likely be characterized by accelerated adoption, increased product launches, and strategic collaborations, all contributing to sustained market expansion for implantable polymer electronics.

Regional Market Analysis: North America, Europe, Asia-Pacific, and Rest of World

The global market for implantable polymer electronics is experiencing robust growth, with significant regional variations in adoption, innovation, and regulatory landscapes. In 2025, North America, Europe, Asia-Pacific, and the Rest of the World (RoW) each present distinct opportunities and challenges for stakeholders in this sector.

North America remains the leading market, driven by advanced healthcare infrastructure, high R&D investment, and a strong presence of key industry players. The United States, in particular, benefits from supportive regulatory pathways and a high prevalence of chronic diseases, which fuel demand for next-generation implantable devices. According to U.S. Food and Drug Administration (FDA) data, the number of approved implantable electronic devices incorporating polymer components has steadily increased, reflecting both innovation and market acceptance. Additionally, collaborations between academic institutions and industry, such as those fostered by the National Institutes of Health (NIH), continue to accelerate product development and clinical translation.

Europe is characterized by a strong emphasis on safety, biocompatibility, and regulatory compliance. The region’s market is bolstered by the presence of leading medical device manufacturers and a growing focus on minimally invasive procedures. The European Commission’s Medical Device Regulation (MDR) has set stringent standards, prompting companies to invest in advanced polymer materials that meet rigorous safety and performance criteria. Germany, France, and the UK are the primary contributors to regional growth, with increasing adoption of implantable polymer electronics in neuromodulation and cardiovascular applications.

- Asia-Pacific is the fastest-growing region, propelled by expanding healthcare access, rising healthcare expenditure, and a burgeoning middle class. Countries such as China, Japan, and South Korea are investing heavily in medical technology innovation. According to Japan’s Ministry of Economy, Trade and Industry (METI), the region is witnessing a surge in local manufacturing and strategic partnerships, particularly in the development of flexible, biocompatible polymers for neural and cardiac implants.

- Rest of the World (RoW) encompasses emerging markets in Latin America, the Middle East, and Africa. While these regions currently represent a smaller share of the global market, increasing government initiatives to modernize healthcare systems and attract foreign investment are expected to drive future growth. The World Health Organization (WHO) highlights the growing need for affordable, durable implantable devices, positioning polymer electronics as a promising solution for resource-constrained settings.

Overall, regional dynamics in 2025 reflect a convergence of technological innovation, regulatory evolution, and shifting healthcare priorities, shaping the trajectory of the implantable polymer electronics market worldwide.

Future Outlook: Emerging Applications and Investment Opportunities

The future outlook for implantable polymer electronics in 2025 is marked by rapid innovation, expanding clinical applications, and increasing investor interest. As the convergence of materials science, bioengineering, and electronics accelerates, polymer-based implantable devices are poised to transform several medical domains, including neuromodulation, cardiac care, and biosensing.

Emerging applications are particularly prominent in neuroprosthetics and brain-computer interfaces (BCIs). Flexible, biocompatible polymers enable the development of minimally invasive neural implants that can conform to soft tissue, reducing immune response and improving long-term performance. Companies and research institutions are advancing polymer-based electrodes for deep brain stimulation, epilepsy monitoring, and spinal cord injury rehabilitation. For example, recent clinical trials have demonstrated the potential of polymer-based BCIs to restore partial motor function in paralyzed patients, a breakthrough that is attracting both public and private funding Nature Nanotechnology.

Cardiac applications are also expanding, with polymer electronics enabling the next generation of pacemakers, defibrillators, and cardiac monitors. These devices benefit from the polymers’ flexibility, allowing for better integration with cardiac tissue and reduced risk of device-related complications. The global market for implantable cardiac devices is projected to grow at a CAGR of 6.5% through 2025, with polymer-based innovations contributing significantly to this expansion MarketsandMarkets.

Investment opportunities are robust, driven by the growing demand for personalized medicine and the shift toward remote patient monitoring. Venture capital and strategic investments are flowing into startups and established firms developing polymer-based implantables, particularly those leveraging wireless communication and real-time data analytics. Notably, the U.S. and Europe are leading in both patent filings and funding rounds, with Asia-Pacific markets rapidly catching up due to supportive regulatory environments and increased healthcare spending CB Insights.

- Neuroprosthetics and BCIs: Enhanced by flexible, biocompatible polymers.

- Cardiac devices: Improved integration and patient outcomes.

- Remote monitoring: Wireless, polymer-based sensors for chronic disease management.

- Investment: Strong VC and corporate interest, especially in the U.S., Europe, and Asia-Pacific.

In summary, 2025 will see implantable polymer electronics move from experimental to mainstream, with new applications and investment opportunities reshaping the medical device landscape.

Challenges, Risks, and Strategic Opportunities

The landscape of implantable polymer electronics in 2025 is shaped by a complex interplay of challenges, risks, and strategic opportunities. As the sector matures, several critical factors influence its trajectory, from material biocompatibility to regulatory hurdles and market adoption dynamics.

Challenges and Risks

- Biocompatibility and Long-Term Stability: Ensuring that polymer-based electronic implants remain non-toxic, non-immunogenic, and functionally stable over extended periods is a persistent challenge. Degradation of polymers in vivo can lead to device failure or adverse tissue reactions, necessitating ongoing research into advanced materials and coatings (Nature Reviews Materials).

- Regulatory Complexity: The regulatory pathway for implantable devices is stringent, with agencies such as the U.S. Food and Drug Administration (FDA) and European Commission requiring comprehensive preclinical and clinical data. The novelty of polymer electronics introduces additional scrutiny regarding safety, efficacy, and manufacturing consistency.

- Manufacturing Scalability: Transitioning from laboratory prototypes to scalable, reproducible manufacturing processes remains a bottleneck. High-precision fabrication and quality control are essential to meet medical-grade standards, which can increase costs and slow time-to-market (IDTechEx).

- Cybersecurity and Data Privacy: As implantable devices become more connected, concerns over data security and patient privacy intensify. Ensuring robust encryption and protection against cyber threats is critical, especially for devices transmitting sensitive health data (McKinsey & Company).

Strategic Opportunities

- Personalized Medicine: Implantable polymer electronics enable real-time monitoring and adaptive therapies, supporting the shift toward personalized healthcare. This opens new markets in chronic disease management, neuroprosthetics, and bioelectronic medicine (BCC Research).

- Collaborative Innovation: Partnerships between material scientists, device manufacturers, and healthcare providers can accelerate innovation and streamline regulatory approval. Strategic alliances with established medtech firms can also facilitate market entry and scale.

- Emerging Markets: As healthcare infrastructure improves in emerging economies, demand for cost-effective, minimally invasive implantable solutions is rising. Companies that tailor products to these markets can capture significant growth potential (Grand View Research).

Sources & References

- MarketsandMarkets

- Nature Nanotechnology

- BioSpace

- IDTechEx

- Medtronic

- Boston Scientific

- Neuralink

- IEEE

- neuroloop

- Massachusetts Institute of Technology (MIT)

- Stanford University

- Fortune Business Insights

- Grand View Research

- National Institutes of Health (NIH)

- European Commission

- World Health Organization (WHO)

- McKinsey & Company

- BCC Research